Business as a Force for Radical Change

Changing the World, One Business at a Time

Kantabai is a welder who worked and lived on the footpath. She hoped to save a little bit of money for a rainy day, literally! Kantabai tried to open a bank account to save money so that she could buy materials to protect her home in the monsoon season. Her request to open an account was rejected by banks. There are millions of women like Kantabai across the globe whom businesses consider as loss-causing.

Most businesses start with a goal to be profitable. They aspire to succeed financially. What would the world look like if every business focused on profit and impact? What if every business balanced between profit for themselves, value to their customers, and impact for the communities they operate in? What would the world look like if every business focused on a purpose while being profitable?

There were an estimated 333 million businesses as of 2021. Most of them generally start from an idea. Most start them with the pure intention of succeeding and making money.

But approximately 20% of new businesses fail in their first year and 45% within 5 years. One of the biggest reasons a business fails is because they are not satisfying a customer's need.

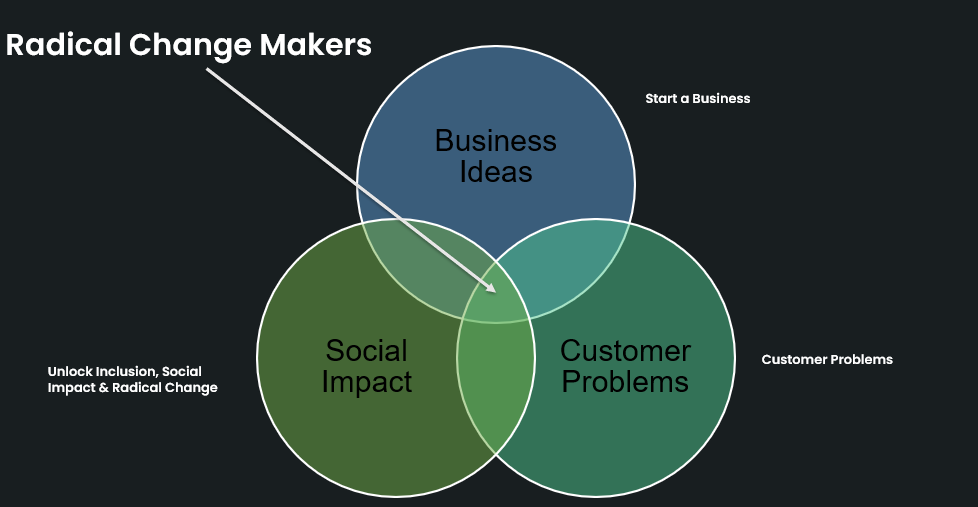

The chances of a business succeeding increase when they focus on overlapping their ideas with customer problems. By doing so, businesses deliver customer value and business value. This brings great results because customers are happy for their problems to be solved which results in business growth for the business.

But what if every business paused to ask themselves how their product could be impactful beyond solving a customer problem? If they widened their aperture and looked at solving for not just a small group of customers but also look for extreme problems that exist in the community, they would identify opportunities for radical change and become Radical Change Makers. Here are a few examples

You meet a young high school student who does not have access to the internet at home and hence is trying to stay late at school or in the local library. You learn about it and help him out by paying for his service. But what if you widened the aperture to learn about all the kids in the community who do not have access to the internet at home? What if you created a business that would deliver wi-fi through local businesses for free for everybody in the community at a low cost? Similar to the wi-fi enabled school buses delivering wi-fi for kids.

Imagine this situation. Bali’s beaches were turning into garbage dumps. You find one beach and would like to help by cleaning up a small patch. But that might be “volunteering”. Instead, you widen the aperture and notice that all beaches are becoming such dumping grounds. Instead of creating a non-profit to clean up, you start a business to collect all plastic from all beaches, clean it, process it, and transform them into chairs to create a business that would fund more clean-up work. Thus was born Sungai Design.

You are not only solving a problem for one person but solving it for many people in the community while creating a business model that will also make the business financially successful.

Radical change starts with one person who decides to solve a problem at scale. That is the story of the massive impact Chetna Sinha had while solving Kantabai’s needs.

Mann Deshi Bank was started by Chetna Sinha when she heard that Kantabai, a welder who worked and lived on the footpath was rejected by banks. Kantabai tried to open an account to save her money so that she could buy materials to protect her home in the monsoon season. Chetna could’ve just solved Kantabai’s problem by letting her save money with her. Instead, she saw the need in the community for more women and decided to start a bank to help more women. She pulled together more than 1000 people to pool their savings and open a bank. Their first request to start a bank was declined by the Reserve Bank of India because the women were uneducated. But the women were not disheartened. They came back in 5 months to reapply after becoming literate. It was the first bank set up for rural women in India and remains a member-driven and member-owned bank.

By focusing on the customer problem - lack of access to a bank account to save money and the broader social context - many women of low income are being left out of banks, Chetna Sinha was able to create a successful bank.

Today, Mann Deshi Bank continues to thrive as a successful bank 27 years after that first encounter between Chetna Sinha and Kantabai. Mann Deshi Bank has 26,000 members, 97 crores deposited, and the value of loans given is 500 crores with a 98% repayment rate. That is a massive success but it started with an individual who thought of what they could do to help another person and then another and then another.

1) Share this article with others!

2) Subscribe to receive future posts directly in your inbox